The agreement between the Welsh Government and the United Kingdom Government on the Welsh Government’s fiscal framework

This agreement implements the powers in the Wales Act 2014. It supports the devolution of stamp duty land tax and landfill tax. It also supports the creation of Welsh rates of income tax.

This file may not be fully accessible.

In this page

Foreword

This agreement represents a significant milestone for Wales. Following the recommendations of the Commission on Devolution in Wales (Silk Commission), the Wales Act 2014 provided the legislative framework to devolve tax and borrowing powers to the National Assembly for Wales and the Welsh Government. These powers provide the Welsh Government with further tools to grow the Welsh economy and to vary the level of tax and spending in Wales, thereby increasing its accountability to the people of Wales.

This agreement will enable the powers in the Wales Act 2014 – and any further powers devolved under the current Wales Bill – to be implemented. In particular, it will support the devolution of stamp duty land tax and landfill tax, and the creation of Welsh rates of income tax (subject to the enactment of the Wales Bill currently before Parliament).

Building on the joint funding announcement in 2012 and the funding floor implemented at the 2015 Spending Review, this agreement puts in place fair, sustainable and coherent funding arrangements across all the Welsh Government’s tax and spending responsibilities. It also provides the Welsh Government with additional capital borrowing powers and a new Wales Reserve to help manage its budget.

The UK and Welsh governments have worked closely and constructively to reach an agreement that is fair for Wales and for the rest of the UK.

We will continue to work together to implement this agreement and the new powers it supports, which will bring benefits to Wales and to the United Kingdom as a whole.

Mark Drakeford AM

Cabinet Secretary For Finance And Local Government

Rt Hon David Gauke MP

Chief Secretary To The Treasury

Context and scope

- This agreement sets out the Welsh Government’s funding arrangements to support its existing responsibilities, the implementation of Wales Act 2014, and any further powers devolved under the current Wales Bill.

- The funding arrangements for areas that are currently within EU competence are outside the scope of this agreement.

- Under the Wales Act 2014, the Welsh Government is taking on the following new tax powers:

- Stamp duty land tax (SDLT) from 2018-19

- Landfill tax from 2018-19

- Welsh rates of income tax (WRIT) from 2019-20 (subject to the removal of the referendum requirement through the current Wales Bill and the Welsh Government setting out its intention to introduce Welsh rates of income tax to the National Assembly for Wales)

- The Welsh Government’s block grant funding is therefore being updated (subject to the enactment of the current Wales Bill and the implementation of Welsh rates of income tax in 2019-20) to reflect these new powers and to address longstanding concerns in Wales about fair funding.

- Alongside these changes to block grant funding, this agreement also covers capital borrowing, budget management tools, treatment of policy spill-over effects and implementation arrangements.

Welsh Government block grant funding

- As summarised in Box 1 and set out in further detail below, the Welsh Government’s new block grant funding arrangements comprise 2 elements: a Barnett-based ‘Holtham floor’ (as proposed by the Independent Commission on Funding and Finance for Wales - the "Holtham Commission") in relation to spending devolution and Comparable block grant adjustments for tax devolution.

Current arrangements and relative funding

- Under the current arrangements, the Welsh Government is largely funded through a block grant from the UK government (the Welsh Government also retains revenues from business rates). Changes to the block grant are determined by the Barnett Formula. Under this formula, the block grant in any given financial year is equal to the block grant in the previous year plus a population share of changes in UK government spending on areas that are devolved to the Welsh Government.

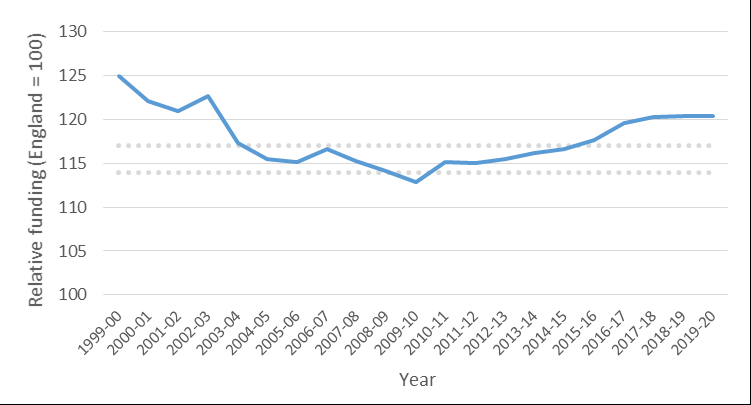

- The Welsh Government has, for some time, been concerned about the rate of convergence in relative funding per head towards the level in England. This was highlighted by the Independent Commission on Funding and Finance for Wales (the Holtham Commission), which was tasked by the Welsh Government to examine its funding arrangements and explore alternative funding mechanisms. The reports, published in 2009 and 2010, suggested Wales had relative needs of 114% to 117% of English needs and expressed concern that relative funding in Wales might fall below this range. This issue of convergence was also recognised in a joint statement by both governments in 2012.

- Examining the Welsh Government’s relative funding per head since 1999-00 shows that until 2009-10, there was a sustained period of convergence towards English funding levels. However, since 2009-10, relative Welsh Government funding per head has diverged from English levels and is expected to be around 120% during the 2015 Spending Review period. This is displayed in the graph below:

Image

Figure 1: Welsh Government relative funding per-head, 1999 to 2020

- There are 2 main causes of the convergence/divergence effect inherent in the Barnett Formula:

- Spending growth – Welsh Government funding per head converges towards English levels when UK government spending grows (in cash terms), all else being equal. Conversely, Welsh Government funding per head diverges when spending falls (again in cash terms), all else being equal.

- Relative population growth – Welsh Government funding per head converges towards English levels when population growth is faster in Wales than England, all else being equal. Conversely, Welsh Government funding per head diverges when population growth is slower in Wales, all else being equal.

- Both of these drivers have been in evidence during the periods of convergence and divergence displayed in the graph above. During the first decade of devolution, rapid convergence was driven by growth in public spending. Thereafter, although public spending is growing in cash terms (and capital spending is growing in real terms) relative Welsh Government funding has actually diverged due to slower population growth. However, when growth in public spending returns to the long-term trend, convergence is expected to resume and relative Welsh Government funding will ultimately fall below the range suggested by the Holtham Commission.

Impact of tax devolution

- The UK government established the Commission on Devolution in Wales (the Silk Commission) in 2011 to examine financial and constitutional arrangements in Wales, and recommend ways in which they might be improved. The Commission concluded the National Assembly for Wales should have stronger financial accountability to the people of Wales while retaining the security and stability of sharing resources as part of the UK.

- In particular, while the National Assembly for Wales already had substantial responsibility for public spending in Wales, the Commission recommended it should have new tax powers. There are 2 key benefits of tax devolution in relation to accountability:

- The Welsh Government becomes responsible for funding more of its spending

- There are more choices for the Welsh Government over the level of tax and spending in Wales.

- This means the Welsh Government’s funding arrangements need to change alongside tax devolution. Specifically, the Welsh Government’s funding will ultimately comprise 2 separate funding streams:

- Revenues from business rates, devolved taxes (stamp duty land tax and landfill tax) and Welsh rates of income tax

- Adjusted block grant funding from the UK government.

- The UK and Welsh governments have been considering how the Welsh Government’s future block grant funding should be determined to deal with both tax devolution and longer-term concerns about the likely resumption of Barnett-based convergence.

Block grant funding principles

- The UK and Welsh governments have agreed a set of block grant funding principles designed to support the development of a robust and sustainable approach to funding:

- Relatively simple to operate and understand – the funding system should use straightforward and objective calculations rather than relying on complex statistical techniques or assumptions

- Not subject to ongoing negotiation – aside from periodic review, the funding system should operate mechanically (like the Barnett Formula)

- Fair funding for the long-term – the Welsh Government should have a fair level of funding based on relative need, subject to appropriate risks in relation to tax devolution

- Consistent treatment of risks and opportunities – the Welsh Government should hold symmetric (and therefore off-setting) risks and opportunities across tax and spending, in particular through using the same population numbers for all elements of block grant funding.

- The new funding agreement set out below meets all of these principles. In particular, it provides the Welsh Government with a long-term and sustainable fair funding guarantee that incorporates a consistent approach to risks and opportunities.

Barnett-based funding floor

- At the 2015 Spending Review (SR15) the UK government implemented a funding floor in Wales. This provided a guarantee that the Welsh Government’s block grant funding per head would not fall below 115% of equivalent funding per head in England. This guarantee was provided for the current Parliament, after which the floor would be reset.

- The 2 governments have now agreed to implement a new funding floor mechanism from 2018-19, which was originally recommended by the Holtham Commission. Under this Holtham floor, all changes in the Welsh Government’s block grant determined by the Barnett Formula will be multiplied by a new needs-based factor. While this retains almost all of the features of the Barnett Formula, there is one key difference – all else being equal, relative Welsh Government funding will converge towards this needsbased factor over time (rather than towards 100% as under the current arrangements). This therefore provides a more mechanical funding floor than the simple floor introduced at SR15.

- The diagram below sets out the existing Barnett Formula and how this will be applied in Wales under this agreement.

Barnett Formula

Change in UK

department

expenditure limitx Comparability

factor (1)x Population

share= Change in Welsh

Government

block grantBarnett Formula to be applied in Wales

Change in UK

department

expenditure limitx Comparability

factorx Population

sharex New needs-based

factor= Change in Welsh

Government

block grant - The governments have agreed this needs-based factor will be set at 115%, based on the range recommended by the Holtham Commission and the funding floor implemented at the SR15. However, for a transitional period, while relative Welsh Government block grant funding per head remains above 115% of equivalent England funding per head, the factor will be set at 105%. From 2018-19 and for the remainder of the current spending review period, all uplifts to Welsh Government DEL above the level in 2017-18 will attract the 105% factor, while any reductions below the 2017-18 level will be applied without the additional factor.

- Relative Welsh Government block grant funding is expected to converge slowly from around 120% into the range recommended as fair by the Holtham Commission (114% to 117%).

- At the point that relative block grant funding reaches 115%, the transition period will end and the multiplier will be set at 115%.

- The 2 governments have agreed a methodology for assessing relative funding and this will be used to determine when the multiplier needs to change from 105% to 115%. The 2 governments have further agreed that input and/or assurance can be sought from independent bodies. Further details on the process for moving to the longer-term post-transition arrangements are outlined in Annex A.

Comparable block grant adjustments for tax devolution

- When further areas of spending are devolved, the changes to the Welsh Government’s block grant funding comprise 2 elements:

- Initial baseline adjustment – this reflects UK government spending plans at the point of devolution

- Subsequent block grant changes – these are based on changes in equivalent UK government spending in the rest of the UK (via the Barnett Formula)

- For tax devolution, there are 2 similar elements:

- Initial baseline adjustment – this reflects tax foregone by the UK government at the point of devolution

- Subsequent block grant changes – these are based on changes in equivalent UK government tax in the rest of the UK

- The initial baseline adjustment for tax devolution is relatively straightforward – the approach that will be used to estimate Welsh taxes at the point of devolution is set out in Annex B. However, as has been widely explored in recent academic literature, there are a range of choices about how subsequent block grant changes are determined.

- Based on the agreed principles, there are 2 key issues:

- Impact of tax base growth – the Welsh Government should have fair funding subject to “appropriate” tax risks.

- Treatment of population change – the same population numbers should be used to calculate changes in the block grant in relation to tax devolution and spending devolution.

- Alongside the Barnett-based funding floor, the UK and Welsh governments have agreed these principles are satisfied by the application of the Comparable model to each of the devolved taxes (stamp duty land tax and landfill tax) and to each band of income tax.

- The diagram below sets out how the Comparable model determines changes in the block grant (after the initial baseline adjustment).

Comparable model

Change in

equivalent UK

government taxx Comparability

factorx Population

share= Change in Welsh

Government

block grant - It should be noted:

- An increase in equivalent UK government tax corresponds to a reduction in the Welsh Government block grant (and vice versa).

- The comparability factor reflects tax per head in Wales as a proportion of the corresponding UK government tax per head at the point of devolution. For example, based on HMRC’s 2015-16 estimates, the comparability factor is 25% for stamp duty land tax and 87% for landfill tax.

- The Comparable model uses the same population share as the Barnett Formula.

- There are 2 further key points:

- Applying the Comparable adjustment to each band of income tax – The UK government remains responsible for defining taxable income across the UK, which includes responsibility for all tax reliefs and the personal allowance. As the composition of the income tax base in Wales is significantly different from the UK average, the two governments have agreed that the Comparable model will be applied separately to each band of income tax (basic, higher and additional rate). This ensures the new funding arrangements will deal with any UK government decisions to change the UK-wide income tax base (for example changes to the personal allowance) entirely mechanically. It will ensure the Welsh Government’s tax revenues are broadly unaffected by UK government policy decisions (there is more information on the treatment of other policy ‘spill-over’ effects later in the agreement). For completeness, the Comparable adjustment will be applied to aggregate changes in the 2 fully devolved taxes.

- Consistent treatment of population change – As noted, in a recent report by the Welsh Governance Centre and Institute for Fiscal Studies, the agreed approach to block grant funding delivers a consistent approach to population change – the same population numbers will be used to calculate changes in the Welsh Government’s block grant funding in relation to both tax and spending (so any impacts of differential growth will offset within the Welsh Government’s funding). This will be the case even during the transitional period.

- Annex B sets out more details on the interaction between these adjustments and the Welsh Government’s tax revenue (in particular the timing of forecasts and reconciliation to actuals).

Policy ‘spill-over’ effects

- As summarised in Box 2 and set out in further detail below, this section covers the treatment of spill-over effects.

- Policy ‘spill-over’ effects occur where a decision by one government has an impact on the tax or spending of another (Footnote 2). There are 3 main categories:

- Direct effects – these are the financial effects that will directly and mechanically exist as a result of a policy decision (before any associated change in behaviour). For example, if the UK government increases the personal allowance then the Welsh Government will receive less revenue from Welsh rates of income tax.

- Behavioural effects – these are the financial effects that result from people changing behaviour following a policy decision. For example, if the Welsh Government sets a different additional rate of income tax (Footnote 3), it may encourage people to move across the border thereby affecting the UK government’s revenues.

- Second round effects – these are the wider economic impacts that may result more indirectly from policy decisions. For example, a change in income tax rates in Wales could affect economic activity and therefore the amount of VAT generated for the UK government in Wales.

- Taking these in turn, the UK and Welsh governments have agreed all direct effects will be accounted for. As set out in the block grant funding section, applying the Comparable model to each income tax band separately will ensure UK government income tax policy decisions (such as changes to the personal allowance) will be dealt with entirely mechanically.

- The UK and Welsh governments have also agreed behavioural effects can be accounted for in exceptional circumstances, where the effects are material and demonstrable, and both governments agree it is appropriate to do so.

- Finally, it has been agreed second round effects will not be accounted for due to the significant uncertainty surrounding the causality and scale of any financial impact.

- For all spill-over effects, assessment of causality and scale of financial impacts will be based on a shared understanding of the evidence. Any transfer relating to a spill-over effect must be jointly agreed by both governments. Without a joint agreement, no transfer will be made. Issues relating to spill-overs will first be discussed by officials in both governments. Where officials are unable to reach an agreement this will be discussed by ministers meeting as the Joint Exchequer Committee (Wales). These discussions may be informed by seeking the view of independent bodies. Where the governments are unable to reach agreement at official or ministerial level a dispute can be raised through the usual channels (see later section on dispute resolution).

Capital borrowing

- As summarised in Box 3 and set out in further detail below, this section covers the changes to the Welsh Government’s capital borrowing powers.

- The Welsh Government’s existing capital borrowing limits (set out in the Wales Act 2014) are being increased.

- Under the Wales Act 2014, the Welsh Government can borrow up to £125 million per year from 2018-19 within an overall cap of £500 million. Within these parameters, the Welsh Government can borrow for any purpose within its devolved responsibilities. In addition, the UK government agreed the Welsh Government could have limited early access to borrowing (in 2016-17 and 2017-18) to take forward improvements to the M4. Amounts borrowed through this early access facility require consent from HM Treasury.

- The Welsh Government can borrow from the National Loans Fund (via the Secretary of State for Wales) or through a commercial loan (directly from a bank or other lender). Following the implementation of the UK government’s St David’s Day announcement, the Welsh Government will also be able to issue bonds. Borrowing for capital expenditure will be in pounds Sterling.

- The governments have now agreed the statutory limit on borrowing for capital expenditure will be increased to £1 billion. The UK government will therefore amend the Wales Bill accordingly. The annual limit on the amount of borrowing for capital expenditure will also be increased. Alongside the introduction of Welsh rates of income tax, the annual limit will be set at 15% of the overall borrowing cap, which is equivalent to £150 million a year. There remain no restrictions about how the Welsh Government can use its borrowing powers to deliver its devolved responsibilities.

- The Welsh Government will notify the Treasury monthly about planned capital borrowing, outstanding debt and repayment profile. The repayment arrangements are to remain consistent with the Wales Act 2014. Under these arrangements, the term of any loan would normally be for 10 years but this can be altered to reflect the expected lives of the assets being purchased through the loan.

Budget management tools

- As summarised in Box 4 and set out in further detail below, this section covers the changes to the Welsh Government’s budget management tools.

- The Welsh Government’s budget management tools are being extended and rationalised. At the moment they comprise:

- Resource borrowing – the Welsh Government can borrow up to £200 million each year (within an overall £500 million cap) if tax revenues are lower than forecast. Repayments must be within 4 years.

- Budget exchange – this facility enables the Welsh Government to carry forward up to 0.6% of its resource DEL budget and 1.5% of its capital DEL budget into the next financial year.

- Cash reserve – the Welsh Government can save surplus revenues into a cash reserve (once any resource borrowing is repaid), which can be drawn down as required in future years. The reserve must be held within the UK government rather than with a commercial bank.

- The 2 governments have agreed the cash reserve and access to the Budget Exchange facility will be replaced with a new Wales Reserve from April 2018. This timing will allow the Welsh Government to save any 2017-18 underspends in the new Reserve to support the devolution of stamp duty land tax and landfill tax and the introduction of their successor taxes in Wales – land transaction tax and landfill disposals tax, respectively, in April 2018. The Reserve will also include £98.5 million as agreed as part of the arrangements for the full financial devolution of non-domestic rates in Wales.

- The Wales Reserve will be held within the UK government and will be separated between resource and capital. Resource funding (including resource block grant and tax receipts) can be paid into the resource reserve. Funds in the resource reserve may be drawn down to fund resource or capital spending. Capital funding (including capital block grant and capital borrowing) can be paid into the capital reserve. Funds in the capital reserve may be drawn down to fund capital spending only.

- The Wales Reserve will be capped in aggregate at £350 million. There are no annual limits for payments into the Wales Reserve. Annual drawdowns will be limited to £125 million for resource and £50 million for capital. The detailed operational arrangements will be agreed between the governments. In line with existing arrangements, Welsh Ministers may request additional flexibility with the consent of Treasury Ministers in exceptional circumstances.

- The governments have also agreed the resource borrowing powers set out in Wales Act 2014 remain unchanged as they already reflect the expected volatility from full implementation of the Welsh Government’s new tax powers, including Welsh rates of income tax).

Implementation arrangements

- While the 2 governments will need to work through the detailed governance and operational arrangements, they have reached high-level agreement in a number of key areas:

- Governance – the implementation of this agreement will continue to be overseen by the Joint Exchequer Committee (Wales), with most of the new funding arrangements implemented during 2017 to begin in 2018-19. The Joint Exchequer Committee (Wales) (Officials) will oversee this work at official level. Memoranda of Understanding will be agreed between the bodies that will perform the duties outlined in this agreement or relating to the operation of the new tax powers, and will then be published.

- Reporting to the UK Parliament and National Assembly for Wales – the two governments recognise accountability to the UK Parliament and National Assembly for Wales is crucial and welcome detailed scrutiny of this agreement. Progress on the implementation and operation of the funding arrangements will continue to be reported to the UK Parliament and the National Assembly for Wales through annual Wales Act 2014 implementation reports.

- Data and information sharing – the 2 governments have agreed a shared objective to ensure all parties have access to the necessary technical, operational and policy information (including data) to discharge their duties. Sharing will be as full and open as possible subject to statutory, commercial and confidentiality restrictions. In particular, the UK government will initially provide information about income tax via the Public Use Tape, but will work with the Welsh Government (as with the Scottish Government) to ensure access to data that supports robust policy development and the production of forecasts of a comparable quality to those produced by the Office for Budget Responsibility (OBR). Data must be provided in sufficient time to support the production of forecasts in advance of the Welsh Government’s draft Budget. The UK government will also require access to information about fully-devolved taxes in order to undertake wider compliance activities.

- Forecasting responsibilities – the OBR will continue to produce all UK-wide economic and fiscal forecasts for the UK government (which includes revenues from taxes devolved in Wales. The Welsh Government will be able to decide whether to use the OBR’s forecasts or to put in place alternative independent forecasting arrangements. For a short period the Welsh Government may produce its own forecasts, while putting in place independent forecasting arrangements. The Welsh Government’s own forecasts would be subject to independent scrutiny. The OBR will also produce all forecasts of relevant UK government taxes that are required to operate the Comparable model for stamp duty land tax, landfill tax and each band of income tax.

- Financial reporting – building on existing reporting arrangements, the Welsh Government will provide regular financial information to the UK government, Office for National Statistics and OBR setting out its tax, borrowing and spending plans. This will include planned capital borrowing for the whole of the Spending Review period (updated in advance of each financial year), planned drawdown of funding from the Wales Reserve in advance of each financial year, monthly in-year funding/spending data and five-year tax forecasts.

- Implementation and running costs – as set out in the Statement of Funding Policy, the Welsh Government will meet all the net costs of devolution including implementing and operating Welsh rates of income tax.

- Periodic review – the 2 governments have agreed that, although the agreement is expected to operate without regular renegotiation, it should be subject to periodic review. The first review will take place before the end of the block grant funding transitional period, and may include input from independent bodies. Either government can request a review but it is not intended that these arrangements will be reviewed more than once during an Assembly or Parliamentary term.

- Dispute resolution – the dispute resolution process set out here applies to all disputes relating to the implementation or operation of this agreement. These disputes will firstly be considered by officials, initially at working level and then by JEC (Wales) (Officials). Where officials are unable to reach an agreement this will be considered by ministers at JEC (Wales). Discussions may be informed at any stage by seeking the view of independent bodies. If ministers fail to reach agreement the dispute falls – there would be no specific outcome from the dispute and so no fiscal transfer between the governments. If either government wishes to pursue the dispute further, the processes outlined in the Memorandum of Understanding between the UK government and the devolved administrations provides that basis.

- All remaining operational arrangements will be finalised prior to implementation.

Annex A: Relative funding methodology

This annex summarises the agreed relative funding methodology.

This is designed to compare Welsh Government block grant funding per head against equivalent UK government funding per head in England (UK government funding for England on areas that are devolved in Wales).

This methodology will be used at each Spending Review to determine when relative Welsh Government block grant funding per head reaches 115% of comparable UK government funding per head in England, at which point the needs-based factor of 115% will replace the transitional 105%. Specifically, the change will take place from the first year where relative Welsh Government funding is projected to be 115.0% to the nearest 0.1% (below 115.05%). Input may be sought from independent bodies to support this process.

The agreed methodology involves 4 steps:

- Welsh Government funding is based on total DEL before any adjustments for tax devolution.

- Equivalent UK government funding for England is calculated by multiplying each department’s total DEL by the comparability factor used in the Barnett Formula (Footnote 4) (where the comparability factor reflects the proportion of each department’s spending on areas that are devolved in Wales).

- An adjustment is made to each of the above to deal with the unique treatment of non-domestic rates (explained below).

- The ONS principal population projections are used to calculate funding on a per head basis.

An adjustment is required in relation to non-domestic rates to compare relative Welsh Government funding against the range recommended by the Holtham Commission, which considered the position before tax devolution. While we can use Welsh Government total DEL before block grant adjustments to deal with stamp duty land tax, landfill tax and Welsh rates of income tax, a different approach is required for the devolution of non-domestic rates as this is uniquely dealt with within the Barnett-based block grant.

The agreed solution is to add non-domestic rates into the funding totals calculated in steps 1 and 2 above. To remove the effects of divergent policies, the assumption is made that non-domestic rate revenues in Wales would have grown at the same rate per head as in England in the absence of devolution. In addition to using English non-domestic rate revenues, the growth in these revenues is used to calculate the appropriate Welsh non-domestic rate numbers.

Annex B: Further details on the operation of the tax block grant adjustments

This annex sets out for each tax:

- How the initial baseline block grant adjustments will be calculated

- When forecasts of corresponding UK government taxes will be made prior to the start of each financial year and whether they will be updated in-year

- When these forecasts will be reconciled to outturn

Stamp duty land tax

- Baseline adjustment – A provisional baseline for the adjustment will use the OBR’s autumn 2017 forecast of receipts in Wales in 2017-18. This will be updated to use actual receipts in Wales in 2017-18 in HMRC’s official statistics publication on stamp duties. The Comparable model will be applied to determine deductions for 2018-19 onwards.

- Forecasting – The Comparable model will use forecasts of UK government stamp duty land tax up to the autumn prior the start of each financial year in question. There will be a further in-year update using the autumn forecasts to ensure that the Welsh Government is shielded from UK-wide economic impacts (in the case of in-year UK government tax policy changes, the Welsh Government will have the option to defer the impact on the block grant adjustment until the final reconciliation when outturn data is available).

- Reconciliation – The forecasts will be reconciled to outturn once these are available around 6 months after the end of the financial year. The outcome of this reconciliation will be applied to the Welsh Government’s funding for the following financial year.

Landfill tax

- Baseline adjustment – A provisional baseline for the adjustment will use the OBR’s autumn 2017 forecast of receipts in Wales in 2017-18. This will be updated to use an estimate of outturn receipts in Wales based on official statistics The Comparable model will be applied to determine deductions for 2018-19- onwards.

- Forecasting – The Comparable model will use forecasts of UK government landfill tax up to the autumn prior the start of each financial year in question. There will be a further in-year update using the autumn forecasts to ensure that the Welsh Government is shielded from UK-wide economic impacts13.

- Reconciliation – The forecasts will be reconciled to outturn once these are available around 6 months after the end of the financial year. The outcome of this reconciliation will be applied to the Welsh Government’s funding for the following financial year.

Welsh rates of income tax

- Baseline adjustment – If the Welsh Government sets all 3 Welsh rates at 10% in 2019-20 (the earliest possible introduction date, subject to the enactment of the Wales Bill and the Welsh Government setting out its intention to introduce Welsh rates of income tax to the National Assembly for Wales) then the baseline adjustment will equal the receipts collected in that year. If the Welsh Government sets different rates then the baseline adjustment will equal an estimate of what would have been generated by 10%. In either scenario, this will provisionally use an OBR forecast and will be updated once actual receipts are available in the summer of 2021. The Comparable model will subsequently be applied to determine further deductions for 2020-21 onwards.

- Forecasting – The Comparable model will use forecasts of UK government income tax up to the autumn prior to the start of each financial year in question. The UK government will also transfer the Welsh Government’s income tax revenues based on Welsh independent forecasts or the OBR autumn forecast until arrangements for Welsh independent forecasts are in place. As the Welsh Government does not therefore hold any in-year risk, there will not be an in-year update.

- Reconciliation – The forecasts will be reconciled to outturn once these are available around 15 months after the end of the financial year. The outcome of this reconciliation will be applied to the Welsh Government’s funding for the following financial year.

Footnotes

[1] The comparability factor reflects the proportion of spending by the relevant UK department on areas that are devolved.

[2] Note this doesn’t include decisions by the UK government that affect block grant funding, as this is the fundamental basis of the Barnett Formula (and associated arrangements for tax devolution).

[3] The design of Welsh rates of income tax means that the Welsh Government determines whether there are differential rates of income tax between Wales and England (as UK rates are paid by English taxpayers while ‘UK rates less 10p’ are paid by Welsh taxpayers).

[4] The comparability factors used will be those in the most recent Statement of Funding Policy unless there are machinery of government or other changes that are not captured by those factors. Revisions to comparability factors for the purposes of measuring relative funding will need to be agreed by both governments.