Landfill Disposals Tax statistics: October to December 2019

The quarterly statistical release for Landfill Disposals Tax (LDT) published by the Welsh Revenue Authority (WRA). Data includes the weight of and tax due on waste disposed to landfill.

A PDF download of this document will be available soon.

In this page

Main points

For waste disposed to landfill in the period October to December 2019:

- There were 198 thousand tonnes of authorised disposals. This is a fall of nearly half when compared with the same period in 2018. Much of the fall is due to a decrease in relieved or discounted disposals.

- These disposals resulted in £7.6 million tax due. This is a fall of around a quarter from the same period in 2018.

- There is growing evidence of a seasonal pattern emerging in the data. Shorter days in winter months are potentially a factor.

- The 5 landfill site operators paying the most tax accounted for 87% of the total tax due.

- There are 17 authorised landfill site operators covering 23 sites. More information on these landfill site operators can be found on the Welsh Revenue Authority (WRA) website.

About these statistics

Introduction of LDT

From April 2018, Landfill Disposals Tax (LDT) replaced Landfill Tax in Wales. We, the Welsh Revenue Authority, collect and manage LDT. The tax is designed and made in Wales, and the revenue raised will support Welsh public services.

Like Landfill Tax, LDT is a tax on waste disposed to landfill and is charged by weight. Landfill site operators pay the tax and they pass these costs on to other waste operators through their gate fee.

The purpose of the tax is to:

- reduce the amount of waste going into landfill

- encourage less harmful methods of waste management such as recycling and incineration

Value of LDT statistics

LDT statistics are a valuable source of data on the level of waste going into landfill.

Forecasting LDT revenues for Wales in future is an important use of LDT statistics. It is mainly the Welsh Government and the Office for Budget Responsibility that do this.

Data available for LDT

All of the data used in this statistical release is available in a spreadsheet on the headline statistics page.

Data is also available on the StatsWales website.

Key quality information and glossary pages

Please see the separate key quality information and glossary pages while reading this statistical release:

- On our key quality information page, we describe how LDT statistics meet the Code of Practice for Statistics and the dimensions of value, trustworthiness and quality.

- We define relevant terms in the glossary as they are used in this release.

Revisions to LDT statistics

The quarterly estimates in this release are based on the latest three-month accounting period for each landfill site operator. Each LDT return may be verified as part of mitigation and recovery work that the WRA carries out routinely and may therefore be revised in future.

In the following section, we explain the methods we use to derive the statistics from the data supplied in the returns.

Methods used in this release

Accounting periods

Most landfill site operators report to the WRA using standard accounting periods. These align with the end of our reporting quarters.

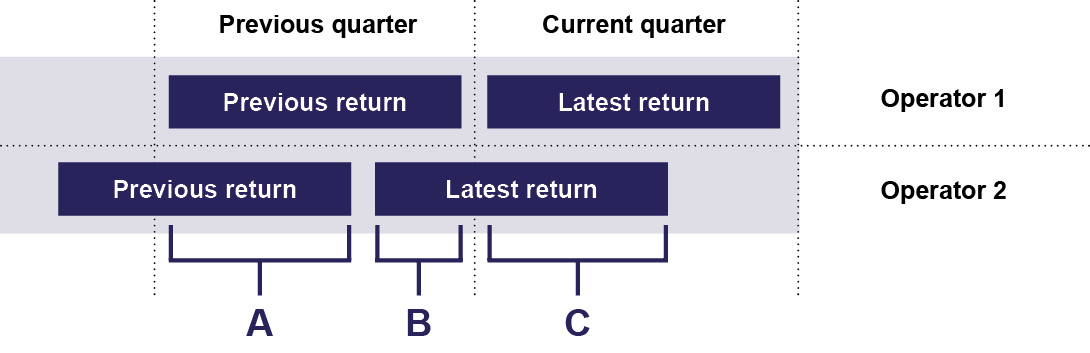

A small number of landfill site operators use different start and end dates for reporting to the WRA. We explain here how we account for this issue when producing estimates for the current and previous reporting quarters.

In the example shown below:

- Operator 1 has a standard accounting period

- Operator 2 has agreed a different accounting period with the WRA. The start and end points are different to our standard reporting quarters

A + B: Two-thirds of the previous return and one third of the latest return are used to give estimates for the previous quarter.

C: The portion of the return covering the latest period is uplifted to give estimates for the current quarter. The uplift is pro-rata based on the number of days in the current quarter covered by the return.

Reliefs and discounts

Where waste is referred to as relieved, landfill site operators initially record this as lower rate waste then subtract it off in a later part of their return. This release reports the relieved waste within the relieved or discounted category but not as part of the lower rate category. Also, the weight of any discounted waste due to water discounts is included only in the relieved or discounted category.

Unauthorised disposals

No data are yet available on unauthorised disposals. We will keep this under review. When we have enough data, we will provide more detail on our approach to publishing information about unauthorised disposals.

Customer insolvency

The LDT system allows for a credit to be made against the tax due for customer insolvency. This is when a customer of the landfill site operator has gone out of business and is unable to pay the operator for the waste disposed to landfill.

Previously, a very small amount of credit was claimed by one operator in the reporting quarter July to September 2018. However, the WRA rejected this claim and tax was due on this amount.

A small amount of credit was claimed by one operator for the reporting quarter July to September 2019. The WRA approved this claim. In this statistical release, we have subtracted the amount claimed from the total tax due.

Exempt disposals

Certain disposals of material can be treated as exempt from LDT and therefore are not reported to the WRA. We do not collect data on these exempt disposals.

Analysis

Tax rates that apply to Tables 1a and 1b

The Welsh Government has set rates that match those in the rest of the UK for 2018-19 to 2020-21.

|

Standard rate |

Lower rate |

Unauthorised disposals rate |

|

|---|---|---|---|

|

2018-19 |

£88.95 per tonne |

£2.80 per tonne |

£133.45 per tonne |

|

2019-20 |

£91.35 per tonne |

£2.90 per tonne |

£137.00 per tonne |

|

2020-21 |

£94.15 per tonne |

£3.00 per tonne |

£141.20 per tonne |

Table 1a: Weight of waste disposed to landfill [1]

| Relieved or discounted [3] | Lower rate | Standard rate | Total [4] | ||

|---|---|---|---|---|---|

| 2018-19 | 410 | 535 | 483 | 1428 | |

| Apr-Jun | 89 | 146 | 125 | 360 | |

| Jul-Sep | 98 | 119 | 149 | 366 | |

| Oct-Dec | 128 | 131 | 109 | 368 | |

| Jan-Mar | 96 | 138 | 100 | 334 | |

| 2019-20 to date (p) | 81 | 338 | 305 | 724 | |

| Apr-Jun | 32 | 106 | 110 | 248 | |

| Jul-Sep (r) | 23 | 139 | 116 | 277 | |

| Oct-Dec (p) | 26 | 93 | 80 | 198 | |

Landfill Disposals Tax statistics by reporting period, tax rate and measure

[1] This table does not include any information on unauthorised disposals as no data are yet available.

[2] Weights presented have been rounded to the nearest 1,000 tonnes.

[3] This includes weight of water removed from disposed waste, which is zero rated, and the weight of all waste which is subject to any LDT relief.

[4] Totals presented have been calculated based on the unrounded values.

(p) The values are provisional and will be revised in a future publication.

(r) The values have been revised in this publication.

In October to December 2019, there were 198 thousand tonnes of authorised disposals. This is a fall of nearly half when compared with the same period in 2018. This was due to lower levels of waste in the latest period for all three categories in the table, in particular for relieved and discounted waste.

The LDT operations team in the WRA closely monitor relieved and discounted disposals. The levels of relieved activities can vary greatly over time and are dependent on various factors, such as weather. These figures could increase from these lower levels in future periods.

Table 1b: Tax due on waste disposed to landfill [1]

| Lower rate | Standard rate | Total [3] | Relieved tax amount [4] | ||

|---|---|---|---|---|---|

| 2018-19 | 1.5 | 43.0 | 44.5 | 1.0 | |

| Apr-Jun | 0.4 | 11.2 | 11.6 | 0.2 | |

| Jul-Sep | 0.3 | 13.3 | 13.6 | 0.2 | |

| Oct-Dec | 0.4 | 9.7 | 10.0 | 0.3 | |

| Jan-Mar | 0.4 | 8.9 | 9.3 | 0.2 | |

| 2019-20 to date (p) | 1.0 | 27.8 | 28.8 | 0.2 | |

| Apr-Jun | 0.3 | 10.0 | 10.3 | 0.1 | |

| Jul-Sep (r) | 0.4 | 10.5 | 10.9 | ~ | |

| Oct-Dec (p) | 0.3 | 7.3 | 7.6 | ~ | |

Landfill Disposals Tax statistics by reporting period, tax rate and measure

[1] This table does not include any information on unauthorised disposals as no data are yet available.

[2] Values presented have been rounded to the nearest £0.1 million.

[3] Totals presented have been calculated based on the unrounded values.

[4] This is the reduction in tax due to the applications of reliefs. The amount does not include any element for water discount, which is not taxed.

(p) The values are provisional and will be revised in a future publication.

(r) The values have been revised in this publication.

These disposals for October to December 2019 resulted in £7.6 million of tax due. This is a fall of around a quarter from the same period in 2018. This was largely due to a decrease in standard rate disposals by a small number of landfill site operators.

There is growing evidence of a seasonal pattern emerging in the data, with shorter days in winter months potentially a factor. In future, we may be able to isolate these effects from the more general trends in the data. But we will need several years’ worth of data before that becomes possible.

In October to December 2019, the five landfill site operators paying the most tax accounted for 87% of the total tax due. In three-month periods prior to this, the figure has varied between 80-90%.

The relieved tax amount represents how much tax would have been due had the reliefs not have been applied.

Receipts of LDT

Table 2 below shows quarterly receipts received for LDT. This is based on the date the payment was received, sometimes referred to as ‘on a cash basis’.

Table 2: Landfill Disposals Tax (LDT) paid to the Welsh Revenue Authority (WRA) [1]

| Value of LDT payments (£ millions) | ||

|---|---|---|

| 2018-19 | 35.8 | |

| Apr-Sep [2] | 12.2 | |

| Oct-Dec | 13.5 | |

| Jan-Mar | 10.1 | |

| 2019-20 to date (p) | 30.2 | |

| Apr-Jun | 9.2 | |

| Jul-Sep | 10.1 | |

| Oct-Dec | 10.9 | |

[1] Values presented have been rounded to the nearest £0.1 million.

[2] Figures for April to June 2018 have been combined with figures for July to September 2018. This is due to the small number of landfill operators who had already submitted returns and paid before the end of June (most of them submitted and paid in July).

In October to December 2019, we received £10.9 million of LDT payments. This is 19% lower than the same period in 2018.

The trends in these data differ slightly from the tax due data. This is because these trends are influenced by the exact accounting periods agreed with the LDT operators and the resulting payment dates. This can lead to payments falling into different quarters to the activity they cover.

Links to key quality information and glossary pages

The key quality information page describes how our Land Transaction Tax statistics meet the Code of Practice for Statistics and the dimensions of value, trustworthiness and quality.

We define relevant terms in the glossary as they are used in this release.

Feedback and contact details

We would be grateful for your feedback on these statistics, to help us improve them. Please contact us using the details below.

Statistician: Dave Jones

Email: data@wra.gov.wales

Rydym yn croesawu galwadau a gohebiaeth yn Gymraeg / We welcome calls and correspondence in Welsh.

Media

Email: news@wra.gov.wales

Rydym yn croesawu galwadau a gohebiaeth yn Gymraeg / We welcome calls and correspondence in Welsh.