Second homes: What does the data tell us?

This publication provides an overview of the different data sources relevant to second homes in Wales.

This file may not be fully accessible.

In this page

Introduction

There is no single source of data specifically aimed at understanding second home ownership. However, a range of data sources collated for a variety of purposes, and for different time periods, are able to provide some information about second homes and holiday homes. These include Census 2021, Council Tax data, Land Transaction Tax data and Non-Domestic Rates data. This article provides an overview of these sources – the definitions used, strengths, limitations, data availability, and highlights some of the differences between the sources. It also highlights the key points for the latest time period for each of the sources (this differs between sources).

Main points

- There is no common or standard definition of a ‘second home’. Different definitions are used within datasets, as each is collected for a specific purpose.

- Data sources referenced in this report should not be directly compared or combined, due to:

- different definitions

- varying coverage and overlap between sources

- the snapshot nature of some of the data and different reference periods

Census 2021

- Census 2021 collected information on people who usually resided in England and Wales who said they stayed at least 30 days a year at a second address. Information about the location and purpose of the second address were collected, but no questions on ownership were asked.

- Nearly 100,000 second addresses were being used in Wales at the time of Census 2021. Of those, nearly 40,000 were another parent or guardian’s address, 24,000 were students’ home address and 10,070 were holiday homes. Other examples of second addresses included address when working away from home, armed forces address and partner’s address.

- 10,070 second addresses were being used as holiday homes in Wales, a rate of 6.9 holiday homes per 1,000 dwellings. 36,370 people reported using a second address (for at least 30 days a year) as a holiday home in Wales, equivalent to 11.7 holiday home users for every 1,000 usual residents. Concentrations of holiday homes were highest along coastal areas in Gwynedd, Isle of Anglesey and Pembrokeshire.

- The Census does not capture all properties used as ‘holiday homes’ or short term lets – it is based on properties being used as a second address for 30 days a year or more.

Council tax

- For council tax purposes, a second home is defined as a dwelling that is not a person’s sole or main home, is substantially furnished and is used periodically.

- In 2023-24, the estimated number of second homes in Wales where council tax is payable (chargeable homes) is 24,170 (2% of all chargeable homes). This number has remained relatively stable over the last five years. At a local authority level in 2023-24, this proportion is highest in Gwynedd (8.3% of all chargeable homes) and Pembrokeshire (6.5% of all chargeable homes).

Land Transaction Tax

- Land Transaction Tax (LTT) is payable on purchases of residential property. The tax is charged at either the:

- main rates: usually where the buyer does not already own any other dwellings, or where the buyer is replacing their main residence; or

- higher rates: usually where the buyer already owns other residential properties, or for purchases by companies.

- Historically, the Welsh Revenue Authority (WRA) have not directly captured the intended use for properties purchased at higher rates of tax, including for use as a second home or as a buy-to-let property.

- In 2021-22, 23% of all residential transactions were at the higher rates of tax.

- Excluding higher rates transactions which were company purchases and ‘bridging’ (former main residence awaiting sale), an estimated 15% of all residential transactions in 2021-22 were purchases by individuals (which were not bought as a main residence).

Non-Domestic Rates

- Non-domestic rates (NDR), often referred to as business rates, are a local tax through which owners and occupiers (‘ratepayers’) of non-domestic properties contribute financially towards the provision of local services.

- One of the property categories within NDR is properties registered as self-catering holiday accommodation. For this type of accommodation to be classified as non-domestic, operators must provide evidence that certain letting criteria are met.

- There is no requirement for self-catering holiday accommodation to register as non-domestic and so the number of these properties on the NDR list is not necessarily a true reflection of all self-catering holiday lets in Wales. The NDR figures include a variety of property types used for this purpose.

- In 2022-23, there were approximately 11,300 self-catering holiday lets on the NDR list (representing 8.8% of all NDR properties).

Short-term lettings

- Web-scraped data from commercial data sets can provide an indication of housing stock that is being used for short-term letting (STL) purposes only. But this data does not tell us anything about the ownership of those properties or whether they are liable for NDR or Council Tax.

- For 2023 to date, approximately 26,000 unique properties were advertised as STLs. This only includes properties that could be used as homes and excludes single rooms and alternative accommodation such as glamping pods and yurts.

What are ‘second homes’?

There is no common or standard definition of a ‘second home’. According to a 2021 Welsh Government Research on second homes: evidence review summary:

There is no common or consistent understanding of a second home beyond the consensus that it is a property that is not the main residence of the owner. ... The multiple definitions of second homes present particular problems when trying to establish quantitative estimates of the distribution and extent of the dwellings used in this way...

Different definitions for ‘second homes’ apply when dealing with various datasets – as each is collected for a different purpose, with specific definitions used for planning and for tax purposes, for example.

A second home can be used for a variety of reasons including as a private holiday home for the owner or as an address used for work purposes (to stay in whilst working away from the main family home).

There’s no standard definition for ‘holiday home’, and this term is sometimes used to refer to a second address used by the owner(s) for personal holiday purposes, as well as properties where short-term lets are offered. There is an overlap between ‘second homes’ and ‘holiday homes’.

Within the planning context, changes to planning legislation in Wales (the ‘Use Class Order’) make a clear distinction between primary residences, secondary homes and short-term holiday lets. These are predicated on days’ usage. On 20th October 2022 changes to the Town and Country Planning (Use Classes) Order were made to create new use classes for ‘Dwellinghouses, used as sole or main residences’ (Class C3), ‘Dwellinghouses, used otherwise than as sole or main residences’ (Class C5) and ‘Short-term Lets’ (Class C6). The Town and Country Planning (General Permitted Development) Order 1995 (the GPDO) was also amended to allow permitted changes between the new use classes, C3, C5 and C6. These permitted development rights can be dis-applied within a specific area by an Article 4 Direction made by a local planning authority on the basis of robust local evidence.

The definitions used within specific data sets are explained in further detail in the remainder of this article.

Census 2021

What data is available?

The census is undertaken by the Office for National Statistics every 10 years and collects information on people and households in England and Wales. Census 2021 took place in March 2021, during the COVID-19 pandemic.

In addition to reporting their main address, Census 2021 also asked people who usually resided in England and Wales whether they stayed at another address for at least 30 days a year. If they answered yes, they were asked for its address (if within the UK) and the purpose of the second address, with the following options:

- armed forces base address

- another address when working away from home

- student’s home address

- student’s term-time address

- another parent or guardian’s address

- partner’s address

- holiday home

- other

The Census provides us with data on the characteristics of people with a second address (including the location of their usual residence) as well as the location and type of second address. However, no information on second address ownership was collected.

Census data is available for a range of different geographies, including local authorities, wards and small areas such as Lower Layer Super Output Areas (LSOAs) which are part of a hierarchy of statistical geographies (Office for National Statistics).

What does the data tell us about second addresses located in Wales?

This showed that nearly 100,000 second addresses were being used in Wales at the time of Census 2021. Of those, nearly 40,000 were another parent or guardian’s address, 24,000 were students’ home address and 10,070 were holiday homes. Other examples of second addresses were address when working away from home, armed forces address and partner’s address.

The ONS also published analysis of second addresses used (for at least 30 days a year) as holiday homes from Census 2021. An accompanying statistical release summarising the main points for Wales was also published.

In March 2021, 10,070 second addresses were being used as holiday homes in Wales. This was a rate of 6.9 holiday homes per 1,000 dwellings in Wales, which is higher than for every region in England apart from the South West. Concentrations of holiday homes were highest along coastal areas in Gwynedd, Isle of Anglesey and Pembrokeshire.

36,370 people reported using a second address as a holiday home in Wales, equivalent to 11.7 holiday home users for every 1,000 usual residents. At a local authority level, Gwynedd and the Isle of Anglesey had the highest rate of holiday home users, relative to the population, out of all local authorities in England and Wales (79.0 and 63.3 users per 1,000 usual residents respectively).

Of the 36,370 people who were usually resident in England and Wales and reported using a second address as a holiday home in Wales, 26,940 were from England.

Around two-thirds (3,545) of those that used holiday homes in Pembrokeshire were from Wales, predominantly south Wales.

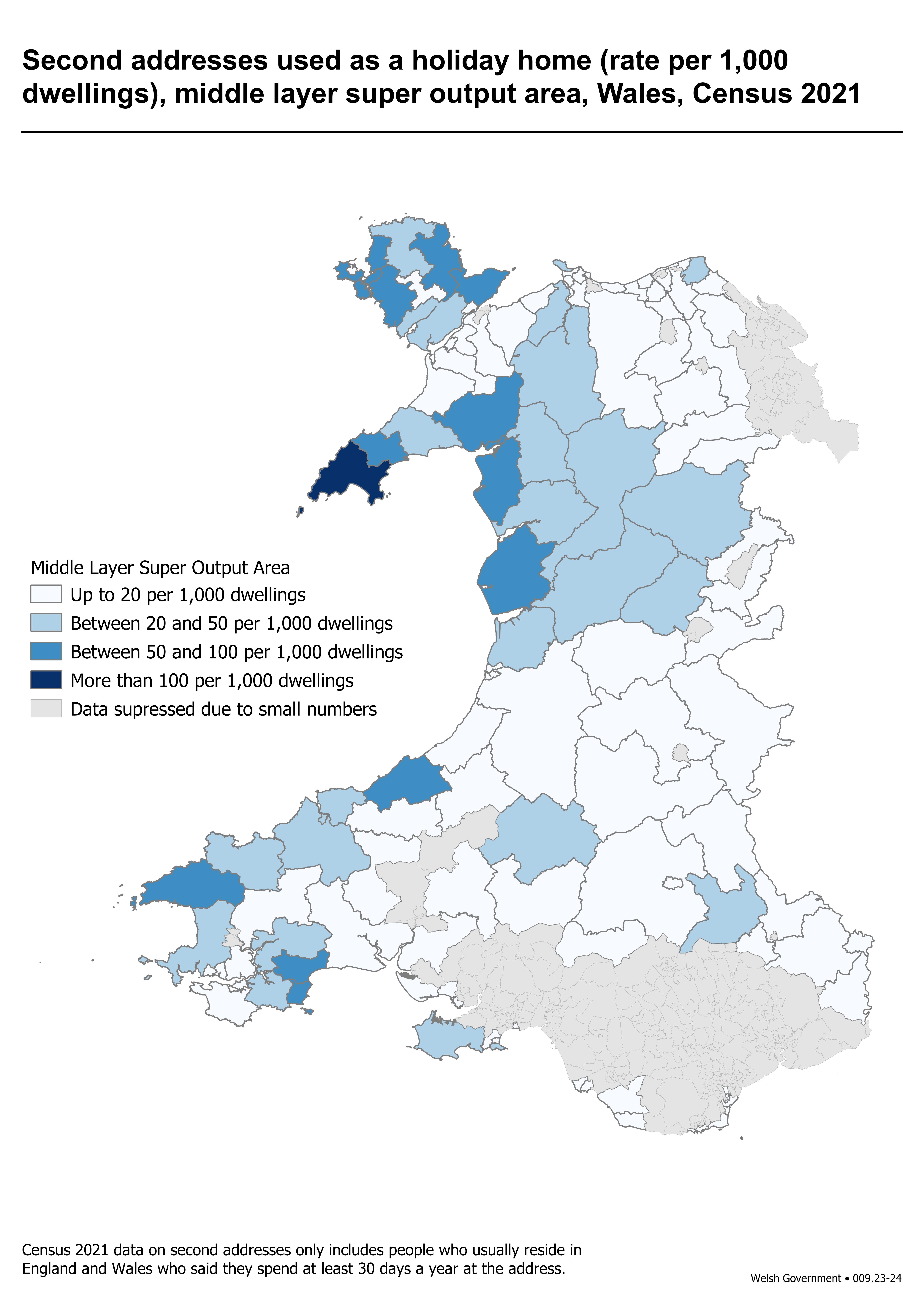

Figure 1 is a map showing second addresses used as a holiday home expressed as a rate per 1,000 dwellings, for areas known as Middle layer Super Output Areas (ONS) (MSOAs). MSOAs comprise of between 2,000 and 6,000 households.

The rate was highest in Abersoch and Aberdaron in Gwynedd, with 153.3 second addresses being used as holiday homes per 1,000 dwellings. The rate was higher than 50, in 13 MSOAs in Wales. These were along coastal areas in Gwynedd, Isle of Anglesey and Pembrokeshire.

Figure 1: Second addresses used as a holiday home (rate per 1,000 dwellings), MSOA, Wales, Census 2021

Description of Figure 1: A map showing second addresses used as a holiday home expressed as a rate per 1,000 dwellings, at MSOA level. The map is described in the commentary.

Source: Census 2021, Holiday homes in England and Wales (ONS)

Additional maps at LSOA and electoral ward level are available. Further data on second addresses (all categories not only holiday homes), and second address users are available on the ONS website.

What does the data tell us about Welsh residents with a second address?

Of those with their main address in Wales, 141,000 people (4.5% of the usual resident population) used a second address within the UK, an increase from 125,000 (4.1%) in 2011. A further 21,000 people in Wales (0.7%) used a second address outside the UK.

The most common types of second address were another parent or guardian’s address (used by 58,000 people, 36.0% of those who used a second address) and students’ home addresses (37,000, 23.2%).

The number of people whose main address was in Wales who reported the use of a holiday home was 18,000 in 2021. This represented 0.6% of all people (a similar proportion to 2011), which was lower than the equivalent figure for England (0.8%).

Additional information on people with a second address is available in: Housing in Wales (Census 2021).

Limitations

The census captured second addresses with a person staying there at least 30 days a year. Census 2021 did not capture data on second addresses that were not stayed at by someone for this time period. If someone owned a second address but never stayed there, or it was not occupied by the same person for 30 days a year or more, it was not captured. The census asked where people lived or stayed, but did not ask about ownership of second addresses. Online guidance for those that have a second property (ONS) was available to respondents.

Population change in certain areas may reflect how the coronavirus (COVID-19) pandemic affected people’s choice of usual residence on Census Day (21 March 2021). These changes might have been temporary for some and more long-lasting for others.

The census counted students at their term-time address. There was some evidence of changes to the term-time population resulting from the coronavirus pandemic. Read more about how the ONS ensured an accurate estimate of students at their term-time address.

Council tax

What data is available?

For council tax purposes, a second home is defined as a dwelling that is not a person’s sole or main home and is substantially furnished. These dwellings are referred to in the Local Government Finance Act 1992 (UK legislation) as ‘dwellings occupied periodically’ but are more commonly referred to as ‘second homes’. The council tax definition of a second home is not limited to properties used as private weekend/holiday homes. It includes for example, dwellings retained for work purposes, dwellings available for sale, seasonal homes and caravans.

The Welsh Government receives council tax data in two forms:

- An automatic extract from the individual Local Authorities’ Revenue and Benefits systems, used by local authorities to process payments to and from local businesses, council tax payers and low income households. Snapshots of property level data are taken on a monthly basis and supplied to the Welsh Government by the ONS; and

- The annual Council Tax Dwellings return, for which local authorities produce council tax tax-base estimates for the numbers of dwellings chargeable for council tax in the upcoming financial year. These estimates are calculated at the local authority level, taking into account the property level data recorded at 31 October each year, and any changes likely to occur in the upcoming financial year.

Note that the Valuation Office Agency (VOA) also publish council tax data which provide statistics on the actual stock of properties rather than forecasts.

The Welsh Government carries out numerous validations of the Council Tax Dwellings return to ensure that the data is correct before it is signed off by the Chief Finance Officer of the local authority. While the property level council tax data does not undergo any formal quality assurance once it is received by ONS, discrepancies have sometimes been discussed with local authorities. The Welsh Government is keen to work with local authorities to better understand the quality of the property level data and ensure it is used appropriately.

What does the data tell us?

This section presents data for chargeable second homes only (dwellings exempt from council tax have been excluded). A dwelling may be exempt from paying council tax for a number of reasons, for example if the dwelling is left empty by someone who is living in a care home. More information on exemptions can be found on the Welsh Government website. Please note that dwellings defined as exempt for council tax purposes may be included in other data sets presented in this article.

Information collected in the Council Tax Dwellings return is published in January of each year and can be viewed on the Welsh Government website. More detailed information is available on StatsWales.

Figure 2: Estimated number of second homes chargeable for council tax in Wales, 2018-19 to 2023-24

Description of Figure 2: A bar chart showing change in the estimated number of second homes chargeable for council tax. The trend is described in the text.

Source: Annual Council Tax Dwellings return

Chargeable empty and second homes, by year (number of dwellings) (StatsWales)

Data collected in the annual Council Tax Dwellings return shows that between 2018-19 and 2021-22, the estimated number of chargeable second homes in Wales increased by 6% (from 23,426 to 24,873). This figure dropped by 4% in 2022-23 to 23,974, increasing slightly to 24,170 in 2023-24.

| Local authority | 2021-22 | 2022-23 | 2023-24 |

|---|---|---|---|

| Isle of Anglesey | 2,139 | 2,208 | 2,236 |

| Gwynedd | 5,098 | 4,720 | 4,758 |

| Conwy | 1,181 | 1,155 | 1,384 |

| Denbighshire | 393 | 397 | 422 |

| Flintshire | 280 | 273 | 269 |

| Wrexham | 0 | 0 | 0 |

| Powys | 1,333 | 1,342 | 1,376 |

| Ceredigion | 1,694 | 1,715 | 1,788 |

| Pembrokeshire | 4,068 | 4,216 | 3,940 |

| Carmarthenshire | 1,113 | 1,061 | 1,000 |

| Swansea | 2,104 | 1,585 | 1,624 |

| Neath Port Talbot | 548 | 495 | 486 |

| Bridgend | 27 | 26 | 74 |

| Vale of Glamorgan | 516 | 452 | 449 |

| Rhondda Cynon Taf | 241 | 273 | 434 |

| Merthyr Tydfil | 214 | 200 | 257 |

| Caerphilly | 238 | 234 | 244 |

| Blaenau Gwent | 0 | 0 | 0 |

| Torfaen | 5 | 4 | 8 |

| Monmouthshire | 200 | 212 | 184 |

| Newport | 4 | 21 | 12 |

| Cardiff | 3,477 | 3,385 | 3,225 |

| Wales | 24,873 | 23,974 | 24,170 |

Description of Table 1: A table showing local authority variation in the estimated number of chargeable second homes. The table shows the estimated number of chargeable second homes in 2023-24 ranges from 0 in Wrexham and Blaenau Gwent to 4,758 in Gwynedd.

Source: Annual Council Tax Dwellings return

Chargeable empty and second homes, by year (number of dwellings) (StatsWales)

At a local authority level, data from the Annual Council Tax Dwellings return shows that the highest estimated number of chargeable second homes can be found in Gwynedd (for 2023-24 there are an estimated 4,758 chargeable second homes, accounting for 8.3% of all chargeable homes) and Pembrokeshire (for 2023-24 there are an estimated 3,940 chargeable second homes, accounting for 6.5% of all chargeable homes).

Information from the property level council tax dataset is not published regularly, but data relating to August 2021 at the local authority and Middle layer Super Output Area (MSOA) level are available on the ONS website (Council Tax chargeable second homes in Wales (ONS)) (please note that data for Swansea and Pembrokeshire was unavailable at this time and that percentages have been supressed where there are fewer than 5 second homes). There are 408 MSOAs in Wales (for further information see Statistical geographies - Office for National Statistics (ons.gov.uk)).

This information can also be viewed on DataMapWales:

- Council Tax chargeable second homes in Wales by MSOA (DataMapWales)

- Council Tax percentage of chargeable second homes in Wales by MSOA (DataMapWales)

Figure 3: Percentage of chargeable dwellings that are second homes by MSOA, August 2021 [Note 1]

Description of Figure 3: A map showing how the percentage of chargeable dwellings that are second homes varies by MSOA. The map shows the greatest percentages of chargeable second homes are found in north west Wales.

Source: Local authorities revenues and benefits systems

Council Tax percentage of chargeable second homes in Wales by MSOA (DataMapWales)

[Note 1] Data unavailable for Swansea and Pembrokeshire.

Consistent with the Council Tax Dwellings return, in August 2021, the highest number of chargeable second homes was found in Gwynedd with 5,535 chargeable second homes, accounting for 9% of all chargeable homes. Within Gwynedd, the percentage of chargeable second homes ranged from 1% in MSOAs 002 and 006 (in the Bangor and Caernarfon areas) to 30% in MSOA 014 (at the far end of the Llŷn peninsula).

We intend to publish an update to this data later in summer 2023.

Land transaction tax

What data is available?

From 1 April 2018, Land Transaction Tax (LTT) replaced Stamp Duty Land Tax (SDLT) on residential and non-residential property and land interests purchased in Wales. The tax rates and tax bands for LTT vary depending on the type of transaction. The Welsh Revenue Authority (WRA) collect and manage this tax on behalf of the Welsh Government.

The WRA publish:

- monthly and quarterly LTT statistics at the Wales level

- annual LTT statistics for a range of geographies within Wales: local authorities, Senedd constituencies, built up areas and National Parks

- an annual article explaining how to interpret local area statistics.

What should we be aware of when interpreting LTT statistics?

Residential transactions can either be charged at the:

- main rates: usually where the buyer does not already own any other dwellings, or where the buyer is replacing their main residence

- higher rates: usually where the buyer already owns other dwellings, or the buyer is not an individual, such as:

- purchasing buy-to-let properties

- buying a second home or holiday home

- buying a new property while trying to sell an existing one (known as ‘bridging’)

- purchases by companies or organisations.

The LTT statistics only include properties sold in the relevant time period. They don’t represent the full stock of properties in any local authority.

When using LTT statistics for local authorities, users should be aware that the number of residential transactions and higher rates residential transactions will vary greatly between authorities. This is due to their varying size and population of local authorities.

One important distinction in terms of second homes is that Land Transaction Tax is ‘episodic’ (depends on facts about the purchase and purchasers at the time the transaction occurs). Whereas Council Tax and NDR are charged on an ongoing basis, incorporating information which is updated periodically about the current value and use of each property.

What does the data tell us?

Annual LTT statistics present higher rates transactions as a percentage of all residential transactions, by local authority and year. This tells us in which local authorities higher rates transactions make up a larger or smaller share of all residential transactions in a local authority.

Figure 4: Higher rates transactions as a percentage of all residential transactions, by local authority, 2019-20 and 2021-22

Description: Figure 4 shows the wide variation between local authorities in the level of higher rates residential transactions. This data is presented as a percentage of all residential transactions.

Source: Analysis of Land Transaction Tax returns to the Welsh Revenue Authority

Residential LTT statistics by measure and local authority on StatsWales

Higher rate transactions were generally more common in authorities in the northern and western parts of Wales, which will partly be influenced by purchases of second homes or holiday homes. In 2021-22, the highest percentages were seen in Gwynedd (37%), Isle of Anglesey (32%) and Pembrokeshire (30%). The lowest percentages were seen in Monmouthshire (15%) and Torfaen (16%). The percentage for Wales was 23%.

For 2021-22, the ordering and distribution of local authorities in this chart is similar to 2019-20 (data extracted in June 2020). We are comparing the latest year of data against 2019-20 rather than 2020-21, due to the impacts of coronavirus (COVID-19) in that year. The local authorities with the largest percentage changes between the 2 years were:

- Merthyr Tydfil (increase of 5 percentage points)

- Isle of Anglesey, Carmarthenshire and Monmouthshire (each with a decrease of 4 percentage points)

- Powys, Caerphilly and Cardiff (each with a decrease of 3 percentage points).

A historic limitation of the higher rates data is that it doesn’t describe the intent behind the higher rates transactions. For example, whether a property is purchased as a buy-to-let, for use as a second home or for another reason. The annual article explains how to interpret these local area statistics and how higher rates transactions can be broken down further. The article explains how:

- it is possible to separate out data on purchases made by companies from purchases made by individuals

- to estimate what is known as ‘bridging’; that is where an individual is buying a property as a new main residence where they’ve not yet sold their previous main residence at the time of purchase

Subtracting purchases by companies and estimates of ‘bridging’ from the total higher rates transactions gives estimates for the number of individuals buying property for use other than as a main residence.

Figure 5: Approximate percentage of residential transactions in different LTT higher rates categories, 2021-22

Description: Figure 5 shows the wide variation between local authorities in purchases by companies, purchases by individuals (outstanding bridging – former main residence awaiting sale), and purchases by individuals (not bought as a main residence).

Source: Analysis of Land Transaction Tax returns to the Welsh Revenue Authority

By excluding company purchases and outstanding bridging cases from the total higher rate transactions, we’re left with a better estimate of purchases made by individuals (which were not bought as a main residence).

Figure 5 shows that when considering purchases by individuals (not bought as a main residence) as a percentage of all residential transactions, there is a wide variation between local authorities. These percentages range from 9% in Monmouthshire to 28% in Gwynedd. The percentage for Wales was 15%.

Whilst this still doesn’t allow us to clearly identify the number of second homes purchased each year, or the intended use of them, it does bring us closer to an understanding.

What future work is planned?

In July 2023, the WRA will publish an annual update for 2022-23 to:

- LTT statistics by geography

- the article explaining how to interpret LTT statistics for local areas

The WRA plan to investigate whether they can publish some geographic statistics more frequently. For example, LTT statistics by local authority and quarter. Please contact data@wra.gov.wales to share any views you have on these possibilities.

In June 2023, the WRA introduced a new question on the LTT return. This question asks about the intent behind residential purchases at the higher rates of tax, including second home purchases and buy-to-let properties.

The WRA plan to review the quality and usefulness of this data, in conjunction with investigating linking our data to existing data sources such as data held by Rent Smart Wales. The WRA will provide a further update on the potential analysis that could be carried out. This update is likely to be available alongside the summer 2024 update to annual LTT statistics and the articles explaining how to use local area statistics. A known limitation of the new question on the return will be that the responses can only reflect the intention for use at the time of purchase. That intended use could change after the purchase happens.

Non-Domestic Rates

What data is available?

Non-domestic rates (NDR), often referred to as business rates, are a local tax through which owners and occupiers (‘ratepayers’) of non-domestic properties contribute financially towards the provision of local services.

The Valuation Office Agency (VOA), which is independent of the Welsh Government, values properties for the purposes of charging NDR. As part of the valuation (or ‘rating’) process, the VOA categorises properties according to their use. One of these property categories is properties registered as self-catering holiday accommodation.

For self-catering holiday accommodation to be classified as non-domestic, operators must provide evidence that it meets certain letting criteria. From 1 April 2023, the property is required to be made available to let for at least 252 days of the year, and actually let for at least 182 days. This is an increase from previous criteria, of 140 days available and 70 days let, which had been in place since 1 April 2010.

Properties that do not meet these criteria are recorded on the council tax list and are liable for council tax. There is no requirement for self-catering holiday accommodation to register as non-domestic and so the number of these properties on the NDR list is not necessarily a true reflection of all self-catering holiday lets in Wales.

The Welsh Government receives NDR data in three forms:

- Local authority financial returns, received annually. These are at a local authority level and no information about property type is contained within this data

- Local authority billing information, received annually. This data is received at a property level and includes property type, location and information about the amount of NDR due and any reliefs applied

- VOA ratings information, received twice-yearly. This data is received at a property level and includes property type and location.

Both of the individual property-level datasets are restricted to internal Welsh Government use only, for the development and monitoring of non-domestic rates policy. No data are published by the Welsh Government. However, the VOA does annually publish data aggregated from its NDR rating list: Non-domestic rating: stock of properties collection - GOV.UK (www.gov.uk)

What does the data tell us?

The VOA publish data at a Wales level on the number of self-catering lets on the NDR list. Data are available for 2013-14 to 2022-23.

Figure 6: Self-Catering Holiday Lets on the Non-Domestic Rating List in Wales

Description of Figure 6: A bar chart showing change in the number of self-catering holiday lets. The trend is described in the text.

Source: Valuation Office Agency

The number of self-catering holiday lets on the NDR list has almost trebled over the last decade, increasing from 3,900 in 2013-14 to 11,300 in 2022-23. In 2013-14, self-catering properties made up 3.6% of all NDR properties. Each year this proportion has increased and was at 8.8% in 2022-23.

For context, the number of hotels, guest houses and other leisure accommodation remained stable from 2013-14 to 2022-23, seeing neither major increases nor decreases. There are roughly 600 hotels and 800 guest houses listed each year.

Short-term lettings

What data is available?

Short Term Lets (STLs) comprise a significant portion of the holiday accommodation in Wales and a wide variety of property types (these are self-classified by owners and include apartments, houses, bed and breakfasts and glamping). The Welsh Government purchases web-scraped data from Transparent, which includes data from AirBnB, Booking.com, Vrbo, TripAdvisor and proprietary data from independent property management systems. The data is primarily used by Visit Wales to understand the performance of the visitor economy.

What should we be aware of when using short term let data?

The data can provide an indication of housing stock that is being used for STL purposes only – it does not tell us anything about the ownership of those properties or whether they are liable for NDR or Council Tax. STLs are highly dynamic, with properties being withdrawn and added at different points throughout the year and for variable periods of time. In addition, properties added to the websites are not always “new stock” and can often reflect accommodation providers who are changing their booking channels for commercial reasons. Therefore, Transparent cannot accurately measure the growth of STLs but provides an indication of the scale of the sector.

What does the data tell us?

The chart below shows the total unique properties advertised as STLs. This only includes properties that could be used as homes and excludes single rooms and alternative accommodation such as glamping pods and yurts.

Figure 7: Unique advertised properties, 2019 to 2023 (to 29 May), Transparent

Description of Figure 7: A chart to show the number of unique properties that could be used as second homes advertised on AirBnB, Booking.com, Vrbo, and Tripadvisor for the period 2019 to 29 May 2023.

Source: Transparent, downloaded 29 May, 2023

Further breakdowns by LA: Compendium of visitor and visitor accommodation provider data sources (gov.wales)

What future work is planned?

Data on the occupancy of STLs is being integrated into the wider reporting on the occupancy of the accommodation sector. The STL data is made available for ad hoc analysis to support decision making in Visit Wales and for destinations across Wales, alongside informing wider policy areas.

Other data sources

A range of other data sources are published which relate to house prices and affordability more widely, but do not look at ‘second homes’ specifically.

The UK House Price Index is a National Statistic that shows changes in the value of residential properties in England, Scotland, Wales and Northern Ireland. Data is published monthly by ONS and HM Land Registry, and is available at country and local authority level. UK House Price Index: reports - GOV.UK (www.gov.uk).

ONS also publish House price statistics for small areas in England and Wales on an annual basis, updated quarterly. These provide estimated average property prices for areas smaller than local authorities, such as wards and middle layer super output areas (MSOA).

ONS publish housing affordability ratios, which capture the relationship between house prices and household income across the UK. These are available at the MSOA level. It is supplemented by a series of additional measures of housing affordability.

Data linkage

The Administrative Data Homes Project (AD|Homes), formally known as the Housing Stock Analytical Resource (HSAR), is a data linkage project within Welsh Government bringing together various administrative datasets relating to homes in Wales. Recent data acquisitions include council tax information at property level collected directly from Welsh local authorities by the ONS. We intend to explore how we can use the data to which we have access to further our understanding of the fabric and condition of second homes, for example, linking property level council tax data to Energy Performance Certificate (EPC) records to identify how the energy efficiency of second homes compares to other types of homes. We welcome suggestions for relevant pieces of work at stats.housingconditions@gov.wales

Quality information

Detailed quality and methodology information for each of the data sources referenced in this report can be found in the original data source for these publications. Links to these documents are provided in the relevant section.

Notes on the use of statistical articles

Statistical articles generally relate to one-off analyses for which there are no updates planned, at least in the short-term, and serve to make such analyses available to a wider audience than might otherwise be the case. They are mainly used to publish analyses that are exploratory in some way, for example:

- introducing a new experimental series of data

- a partial analysis of an issue which provides a useful starting point for further research but that nevertheless is a useful analysis in its own right

- drawing attention to research undertaken by other organisations, either commissioned by the Welsh Government or otherwise, where it is useful to highlight the conclusions, or to build further upon the research

- an analysis where the results may not be of as high quality as those in our routine statistical releases and bulletins, but where meaningful conclusions can still be drawn from the results

Where quality is an issue, this may arise in one or more of the following ways:

- being unable to accurately specify the timeframe used (as can be the case when using an administrative source)

- the quality of the data source or data used

- other specified reasons

However, the level of quality will be such that it does not significantly impact upon the conclusions. For example, the exact timeframe may not be central to the conclusions that can be drawn, or it is the order of magnitude of the results, rather than the exact results, that are of interest to the audience.

The analysis presented does not constitute a National Statistic, but may be based on National Statistics outputs and will nevertheless have been subject to careful consideration and detailed checking before publication. An assessment of the strengths and weaknesses in the analysis will be included in the article, for example comparisons with other sources, along with guidance on how the analysis might be used, and a description of the methodology applied.

Articles are subject to the release practices as defined by the release practices protocol, and so, for example, are published on a pre‑announced date in the same way as other statistical outputs.

Contact details

Statistician: Luned Jones

Email: stats.housing@gov.wales

Media: 0300 025 8099