Consultation on the splitting of non-domestic properties in Wales for valuation purposes

We want your views on proposed changes to legislation about ratepayers who occupy more than one unit of property in a shared building.

This file may not be fully accessible.

In this page

Introduction

For over 50 years, ratepayers who occupied more than one unit of property in a building shared with other businesses and organisations were assessed for non-domestic rates (NDR) based on the following premise:

- Where their units of property were contiguous (touching), they received one rates bill.

- Where their units of property were separated by another business or an area in shared use, they received a rates bill for each unit of property.

For example, this meant:

- Where a business occupied two adjoining floors of a building or two rooms separated by a wall only, they received one rates bill.

- Where the business occupied two floors separated by another floor used by another business, or they occupied two rooms on either side of a common corridor, they received two rates bills.

In 2015, the Supreme Court ruled, in the case of Woolway (VO) v Mazars [2015] UKSC 53 (“the Mazars decision”) that the test should concern the geographical nature of the property and, as a result, the VOA has changed its practice.

Since the Supreme Court ruling, separate units of property in a shared building are treated as separate rating units and a rates bill is issued for each unit, irrespective of whether they are in the same occupation and are contiguous. As a result, some ratepayers who were previously receiving only one rates bill now receive two or more. In some cases, they have had to pay more in non-domestic rates as a result of this change, while in other cases, bills have fallen.

This consultation seeks views on the Welsh Government’s proposal to reinstate the relevant elements of the VOA’s practice prior to the ruling.

This consultation applies to Wales only, but similar changes have already been implemented by the UK Government, to reinstate the VOA’s previous practice with respect to rating in England.

Context

Prior to the Mazars decision, the Court of Appeal judgement in Gilbert (VO) v S Hickinbottom and Sons Ltd [1956] 2 Q.B. 40 was regarded as the leading case on the identification of the unit of assessment (known as ‘the hereditament’) for NDR.

Following the general rules set out in that case, it was the practice of the VOA to treat contiguous properties as a single hereditament, when occupied by the same person. The VOA approach to the meaning of contiguous was to treat two units of property as such where they were separated only by a wall or floor/ceiling. For example, a wall or floor or ceiling between two otherwise contiguous offices may contain services in a void, used by the landlord, but such spaces were not considered by the VOA to prevent the units of property being contiguous.

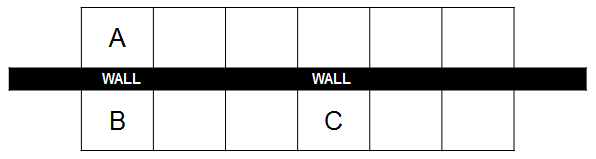

Taking the example below, rooms A, B and C are on the same floor, in the same occupation, and connected by a common corridor (not shown). Rooms B and C are separated by other rooms in different occupation. The VOA would have considered rooms A and B to be contiguous and form one hereditament, but not room C, which would form a separate hereditament.

In the example below, room D is on the floor above rooms E and F, in the same occupation and connected by common corridors and stairs (not shown). The VOA would have considered rooms D and E to be contiguous and form one hereditament, but not room F, which would form a separate hereditament.

There were some exceptions to the general rules:

- Two contiguous properties in the same occupation would still be treated as separate hereditaments where the two parts were used for wholly different purposes. An example might be where one part was capable of separate letting and was not in use.

- Two non-contiguous properties separated by a public highway or common area (such as a common corridor) would still be assessed as a single hereditament where a sufficiently strong functional connection could be shown to exist between the two parts. An example would be two parts of a leisure park separated by a road.

These general rules were widely accepted and adopted in non-domestic rating.

The Mazars case

In the Mazars case, the Supreme Court found that the primary test in determining what a hereditament is should concern the geographical nature of the property.

As a result of the Mazars decision, the VOA changed its approach. The general rule now being operated in Wales is that two contiguous properties in the same occupation are only assessed as one if they can be considered a self-contained piece of property. Typically this will apply if both parts are physically accessible from each other without having to go onto other property or through commons parts (such as a common corridor or stairwell).

In the examples above, properties A and B and D and E would all now be rated separately and receive their own rates bills. If the ratepayer created a door through the wall between properties A and B, or a staircase through the floor/ceiling between properties D and E, the units would again be one hereditament.

Properties which would otherwise form a single hereditament may still be separately assessed when used for wholly different purposes. And two separate properties may still be assessed as one if there is a sufficiently strong functional connection between them.

The impact of the Mazars decision

The change in VOA practice following the Mazars decision led to 466 cases being identified in Wales. The cases were mainly identified in time to alter the 2010 rating list, with 54 identified once the 2017 rating list had been published.

Of the properties affected by the decision, 57 saw no change to their rateable value (RV), 246 saw a rise, while 163 saw a decrease. Both increases and decreases saw an average change in the RV of around £4,500 either way, as a result of the change in methodology.

The overall impact of the change on the tax-base is an increase in RV of £480,000. This results in an increase in revenue collected by local authorities, once the annual multiplier and reliefs are taken into consideration.

The impact on revenue is known to be modest, based on the balance of changes in RV. It has not been possible to calculate the precise impact, due to factors such as the multiple property limit for ratepayers receiving Small Business Rates Relief. There are also a range of other factors which could result in the rateable value changing.

Increases to the overall RV due to the loss of ‘quantum discount’

In rating valuation, larger properties may attract a lower value for each square metre of space than similar smaller properties. This reflects the practice in the market under which landlords will agree a discount to tenants who take more space. This is known as a ‘quantum discount’.

Some of the properties previously assessed as one hereditament before the Mazars decision would have benefitted from this quantum discount. The separate assessment of those properties by the VOA, as a result of the Mazars decision, may have reduced or removed the quantum discount. As a result, the overall RV for the properties concerned will increase and the ratepayer may face a higher rates bill. However, it is not possible to say with certainty how much values have changed as a result of the Mazars decision and how much arises from other factors.

Small Business Rates Relief

In Wales, ratepayers are only eligible for Small Business Rates Relief (SBRR) for up to two properties per local authority area and the relief is limited to properties with a RV up to £12,000.

Some ratepayers who were eligible for SBRR, but have seen their property split into parts as a result of the Mazars decision, may have lost the relief because they now have more than two hereditaments per local authority.

Some ratepayers who were previously not eligible for SBRR because their RV was above £12,000 may have become eligible following their hereditament being split for rating purposes.

Limited information is available on the impact any change to the valuation approach would have on eligibility for Small Business Rates Relief.

Reinstating the practice of the Valuation Office Agency prior to the Mazars decision

The purpose of this consultation is to consider:

- whether the relevant elements of the VOA’s practice prior to the Mazars decision should or should not be reinstated; and

- how hereditaments affected by the Mazars decision should be treated.

For example, it would be possible to reflect the following in legislation:

- To prescribe circumstances where two or more hereditaments occupied by the same person shall be treated as a single hereditament.

- To provide that where two or more hereditaments are occupied by the same person and meet the contiguity condition then they shall be treated as one hereditament.

- To set out a contiguity condition. Hereditaments meet the condition where they are contiguous with one another and where there is a chain of contiguity. Two hereditaments might be are contiguous if:

- some or all of a wall of one hereditament forms all or part of a wall of the other hereditament; or

- some or all of the floor of one hereditament forms all or part of the ceiling of the other hereditament.

The Welsh Government could also ensure that hereditaments used for wholly different purposes are not included in the provisions of any proposed legislation. Practice both before and after the Mazars decision is that two or more units of property used for wholly different purposes should be separate hereditaments. Therefore, legislation could exclude hereditaments used for wholly different purposes.

It is not intended that any legislation proposed by the Welsh Government disturbs established case law under which two non-contiguous properties separated by a public highway or common area (such as a common corridor) would still be assessed as a single hereditament where a sufficiently strong functional connection could be shown to exist between the two parts.

The Welsh Government proposes to make secondary legislation to reinstate the practice of the VOA, prior to the Mazars decision, to coincide with the start of the 2023 rating list and apply going forward. If any legislative proposals were to be developed, further consultation would take place on technical aspects as this legislation.

Impact on the 2010 and 2017 rating lists

The Supreme Court decision was made in 2015 and the VOA has since made alterations to the rating lists. Some ratepayers have seen the impact of the Mazars decision backdated to their property as far as 1 April 2010. However, the VOA cannot now amend the 2010 rating list. Since April 2018, the 2010 rating list has been closed other than for proposals already submitted.

The VOA has a duty to maintain the current 2017 rating list and, subject to some limitations, must maintain the rating list retrospectively back to 1 April 2017 as necessary. In order for the VOA to maintain the 2017 rating list to reflect the reinstatement of the practice prior to the Mazars decision, changes to primary legislation would be required.

To allow the VOA to reapply its previous practice to the affected properties on the 2017 rating list, the Welsh Government could potentially legislate for any changes to be retrospective. However, primary legislation could not be delivered in time for the start of the 2023 rating list. It would likely be several more years before an opportunity to make primary legislation were to arise. If retrospective changes were to be made, they would be required to be fair and proportionate and not incompatible with the European Convention on Human Rights.

The Welsh Government proposes to prioritise making changes to apply only going forward and not to backdate the changes to the 2010 or 2017 lists.

Views

We would like to hear your views on the treatment of split properties for rating purposes and the possible impact of reinstating the VOA’s previous practice, as has already been done in England. We would also like to hear your views on how hereditaments impacted by the Mazars decision should be treated, considering the impact of the changes on their non-domestic rates bills.

We recognise that by reinstating the practice of treating split properties in certain circumstances as a single hereditament may affect rates bills for certain ratepayers. We also recognise that retrospective action leads to a more significant impact on those ratepayers whose rates bill increase as a result of changes.

Consultation questions

Question 1

What are your views on the proposal to reinstate the practice of the VOA prior to the Mazars decision?

Question 2

What are your views on the proposal to prioritise making any legislative changes to apply from the start of the 2023 rating list?

Welsh language

‘A Wales of vibrant culture and thriving Welsh language’ is one of seven well‑being goals in the Well-being of Future Generations (Wales) Act 2015.The Welsh Government recognises the importance of Welsh-medium education, and is working towards the aim of a million Welsh speakers by 2050.

Comments are invited about the effects (whether positive or adverse) which changes to the treatment of split properties for rating purposes may have on opportunities for persons to use the Welsh language and on treating the Welsh language no less favourably than the English language.

Question 3

The Welsh Government would like your views on the possible effects that altering the law applicable to the rating of split properties could have on the Welsh language, specifically on:

- opportunities for people to use Welsh; and

- on treating the Welsh language no less favourably than English.

Question 4

Please also explain how you think policy on the rating of split properties could be developed so as to have:

- positive effects or increased positive effects on opportunities for people to use the Welsh language and on treating the Welsh language no less favourably than the English language; and

- no adverse effects on opportunities for people to use the Welsh language and on treating the Welsh language no less favourably than the English language.

Question 5

Do you have any other views on the rating of split properties in relation to Welsh language considerations?

Next Steps

The consultation is open for a 12 week period.Once the consultation has closed, all responses will be analysed and will be used to inform decisions about whether to make changes to the treatment of split properties for rating purposes in Wales.

Responses to consultations are likely to be made public on the internet or in a report. If you would prefer your response to remain anonymous, please tick here:

How to respond

Submit your comments by 1 June 2022, in any of the following ways:

- complete our online form

- download, complete our response form and email LGFR.Consultations@gov.wales

- download, complete our response form and post to:

Non-Domestic Rates Policy Branch

Welsh Government

Cathays Park

Cardiff

CF10 3NQ

Your rights

Under the data protection legislation, you have the right:

- to be informed of the personal data held about you and to access it

- to require us to rectify inaccuracies in that data

- to (in certain circumstances) object to or restrict processing

- for (in certain circumstances) your data to be ‘erased’

- to (in certain circumstances) data portability

- to lodge a complaint with the Information Commissioner’s Office (ICO) who is our independent regulator for data protection.

Responses to consultations are likely to be made public, on the internet or in a report. If you would prefer your response to remain anonymous, please tell us.

For further details about the information the Welsh Government holds and its use, or if you want to exercise your rights under the GDPR, please see contact details below:

Data Protection Officer

Data Protection Officer

Welsh Government

Cathays Park

Cardiff

CF10 3NQ

E-mail: data.protectionofficer@gov.wales

Information Commissioner’s Office

Information Commissioner’s Office

Wycliffe House

Water Lane

Wilmslow

Cheshire

SK9 5AF

Telephone: 01625 545 745 or 0303 123 1113

Website: ico.org.uk

UK General Data Protection Regulation (UK GDPR)

The Welsh Government will be data controller for any personal data you provide as part of your response to the consultation. Welsh Ministers have statutory powers they will rely on to process this personal data which will enable them to make informed decisions about how they exercise their public functions. Any response you send us will be seen in full by Welsh Government staff dealing with the issues which this consultation is about or planning future consultations. Where the Welsh Government undertakes further analysis of consultation responses then this work may be commissioned to be carried out by an accredited third party (e.g. a research organisation or a consultancy company). Any such work will only be undertaken under contract. Welsh Government’s standard terms and conditions for such contracts set out strict requirements for the processing and safekeeping of personal data. In order to show that the consultation was carried out properly, the Welsh Government intends to publish a summary of the responses to this document. We may also publish responses in full. Normally, the name and address (or part of the address) of the person or organisation who sent the response are published with the response. If you do not want your name or address published, please tell us this in writing when you send your response. We will then redact them before publishing.

You should also be aware of our responsibilities under Freedom of Information legislation. If your details are published as part of the consultation response then these published reports will be retained indefinitely. Any of your data held otherwise by Welsh Government will be kept for no more than three years.

Further information and related documents

Number: WG44686

You can view this document in alternative languages. If you need it in a different format, please contact us.