Welsh Procurement Policy Note (WPPN) 010: Project bank accounts

This WPPN encourages use of project bank accounts (PBAs) as a means of addressing poor payment practices in public sector supply chains by facilitating fair and prompt payment.

This file may not be fully accessible.

In this page

Well-being of Future Generations Act’s well-being goals supported by this WPPN

- A prosperous Wales

- A resilient Wales

- A more equal Wales

Points to note

- This Welsh Procurement Policy Note (WPPN) is effective from the date of commencement of the Procurement Act 2023 and the Procurement (Wales) Regulations 2024. For procurements started prior to this date (24 February 2025), please refer to WPPN 04/21.

- It has been updated to reflect new terminology introduced by the Procurement Act 2023 and the Procurement Regulations 2024. It does not constitute a change in policy.

- Any policy should be read in conjunction with the Wales Procurement Policy Statement, the Procurement Act 2023, the Procurement (Wales) Regulations 2024 and the Social Partnership & Public Procurement (Wales) Act 2023.

- It should not be treated as legal advice and is not intended to be exhaustive – contracting parties should seek their own independent advice as appropriate. Please also note that the law is subject to constant change and advice should be sought in individual cases.

- References to the ‘Procurement Act 2023 and the Procurement (Wales) Regulations 2024’ will be expressed herein as “the Procurement Regime”.

1. Purpose

This guidance document supersedes the Procurement Advice Note, ‘WPPN 04/21 Guidelines for deploying Welsh Government Project Bank Accounts Policy and is intended to support the implementation of Welsh Government’s Project Bank Accounts policy.

Use of PBAs supports the Wellbeing of Future Generations (Wales) Act 2015 wellbeing goals of ‘A Prosperous Wales’, ‘A Resilient Wales’ and ‘A More Equal Wales’ in their positive impact on the economy and mental wellbeing by ensuring prompt and fair payment terms that relieve cash flow pressures, particularly on SMEs.

This WPPN sets out a detailed explanation of PBAs, and guidelines for contractors on how to set one up. Devolved Welsh Authorities (DWA) should also refer to WPPN 011 for advice on implementing Welsh Government PBA policy.

2. Background

Project Bank Accounts (PBAs) are a condition of funding on all Welsh Government construction and infrastructure projects and any other contracts deemed appropriate by contracting authorities, which are fully, part or Grant funded by Welsh Government. PBAs are also advised on all construction projects in the wider public sector.

A further update to this WPPN will follow in early 2026 to align with the Social Partnership and Public Procurement (Wales) Act 2023.

3. What is a Project Bank Account?

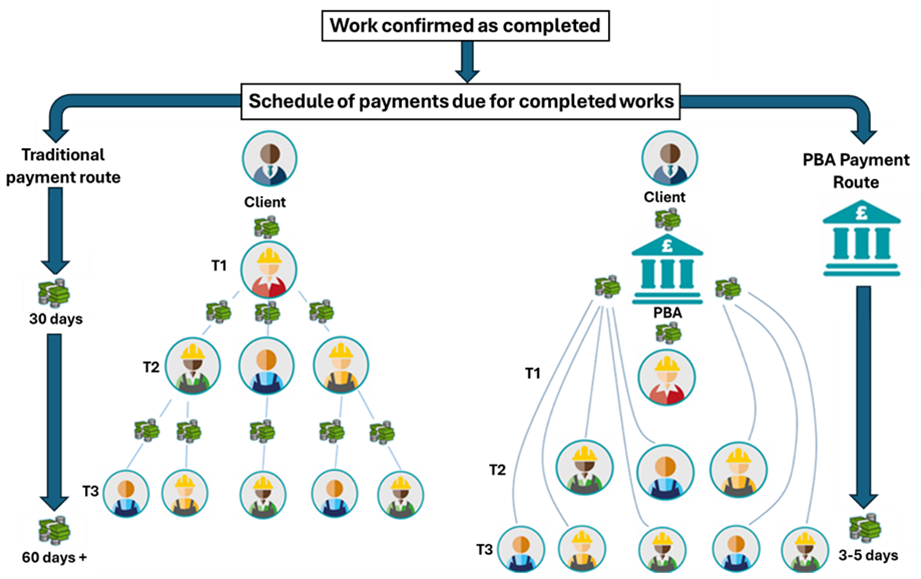

PBAs are ring-fenced bank accounts with trust status that act as a mechanism for making payments. PBAs replace the traditional multi-layered payment terms between tiers in the supply chain with simultaneous payments to the lead contractor and supply chain partners. Traditional payment methods have resulted in sub-contractors commonly having to manage 60-90 day payment terms. Payments via a PBA typically take between 3-5 days from the deposit of money into the account following certification of the payment schedule.

A PBA ensures that:

- Payments are accelerated through the supply chain

- Supply chain spend and payment flows are transparent

- Risks and costs linked to payment delays are mitigated through faster payment

- Risk of supply chain failure is reduced because of improved cash flow and payments protection mechanisms

- Interest accrued where PBAs are set up as interest bearing accounts can, subject to the agreement of the account Trustees, go to the main contractor

- PBAs do not involve DWA prefunding. Money is only deposited in the account when payment is due.

A PBA is made up of:

- Trustee(s) – depending on the type of account these will be DWAs and / or the main contractor who have responsibility for managing the PBA for the benefit of the ‘beneficiaries’.

- Beneficiaries – the main contractor and any participating sub-contractors who receive monies paid out of the PBA. Any supplier involved in the delivery of the project can be a Beneficiary, regardless of what tier they are in.

Participating sub-contractors can either join the PBA at the very start of the project or at a later date. To join, the sub-contractor signs a Joining Deed, which is then countersigned by the Trustee(s).

Exemptions

PBAs are required on all construction and infrastructure projects that receive Welsh Government funding. There are 3 exemptions where a PBA is not required:

- Exemption 1 – Projects valued at less than £2 million

- Exemption 2 – Projects are shorter than 6 months in duration

- Exemption 3 – Where a main contractor gives a firm undertaking to self-deliver over 75% of the contract.

The payment process

The standard processes for assessing the quality and value of work completed and then authorising whether payment can be made, takes place as per the established payment cycle. Payments are still subject to correct invoices being submitted by sub-contractors and main contractors as per the agreed schedule of payments due. DWAs deposit the total amount of monies due into the PBA.

The amount paid into the PBA is then matched to the amounts due to each beneficiary (main and sub-contractors) and the bank is instructed to pay accordingly with beneficiaries receiving the amounts due into their bank accounts within 3-5 working days.

To facilitate this, contractors need to align their supply chain payment cycles and associated invoicing from sub-contractors with the PBA payment cycle agreed with DWAs.

Sub-contractor opt out

If a sub-contractor wishes to not be part of a PBA, they should be complete the opt-out form (Annex 1). DWAs are responsible for ensuring that sub-contractors confirm and document the reasons for opting out. This will allow DWAs to check that sub-contractors opting out are clear about how PBAs operate and the potential benefits to them to ensure that they have not been put under any pressure to opt out by any third party.

If being paid outside a PBA, a mechanism should be in place to pay suppliers promptly by requiring maximum 30-day payment terms for valid invoices to be mirrored down the supply chain for the project / contract. This will ensure that sub-contracts comply with the Late Payment of Commercial Debts (Interest) Act 1998 (as amended by the Late Payment of Commercial Debt Regulations 2002 (SI 1674) and the Late Payment of Commercial Debt Regulations 2013).

4. Nominated Service Providers

Welsh Government has appointed Lloyds, Barclays and NatWest as PBA Nominated Service Providers. Contractors using these banks can be assured to receive a high level of support and expertise when setting up their PBAs.

Lloyds

- For organisations with £25m+ annual turnover

- Enquiries can be made to welshgovPBA@lloydsbanking.com

Barclays

- For organisations with £6.5m+ annual turnover*

- Existing customers should contact their account manager. New customers should go to Liquidity Management | Barclays Corporate Banking and ‘Request a call back’, stating in the ‘Additional comments’ section that a Welsh Government Project Bank Account is required

NatWest

- For any organisation irrespective of annual turnover

- Enquiries can be made by email to: gig.clientservicesuk@rbs.com and/or telephone: 0345 0303 627

The Trust Deeds for these banks have been approved by Welsh Government. A typical timescale for setting up an account can be 6-12 weeks, including Know Your Customer checks.

Whilst these banks are nominated service providers, contractors are advised to carry out their own research to select their PBA provider.

* Under a joint account only one organisation needs to meet this threshold.

5. Actions required by trustee(s)

- Confirm with the DWA whether the PBA will be a sole or joint account

- Enquire with the bank you have chosen to set up a PBA

- Sign all required documents

- Confirm with the bank that the PBA account meets the minimum requirements

- Inform all sub-contractors that a PBA is in place for the project. Send them all the Joining Deed to join the PBA

- If any sub-contractor wishes to not be part of the PBA, ask them to complete the opt-out form. Once completed this should be sent to the DWA

- Manage payments in the PBA

6. Actions required by devolved Welsh authorities

DWA should share this WPPN with main contractors. WPPN 011 sets out advice for DWA on how to implement Welsh Government PBA policy.

7. Legislation

- Procurement Act 2023

- The Procurement (Wales) Regulations 2024

- Social Partnership & Public Procurement (Wales) Act 2023

- The Well-being of Future Generations (Wales) Act 2015

8. Timing

This WPPN applies to procurements commenced under the Procurement Regime and is therefore effective from the commencement of the Procurement Act 2023 and the Procurement (Wales) Regulations 2024 until it is superseded or cancelled.

For procurements commenced under the PCR 2015 regime, please refer to WPPN 04/21.

9. Welsh Government Wales Procurement Policy Statement (WPPS) relevance

Principle 5

We will support Welsh Government policy objectives relating to progressive procurement, such as the Foundational and Circular Economy, through collaborative, place-based (whether national, regional or local) procurement activity which nurtures resilient local supply chains.

10. Additional information

This guidance document should be read in conjunction with WPPN 011 Project Bank Accounts available via the Welsh Government’s website Procurement policy notes.

An eLearning module on PBAs is available via the NHS Wales Shared Service Partnership Learning@Wales portal. This module will be updated in early 2026.

A Project Bank Account Community of Practice group will be set up in autumn 2025. This group will bring supply chains together to discuss and share experiences of PBAs. If you would like to be part of this group, please contact CommercialPolicy@gov.wales.

11. Contact details

Enquiries linked to this WPPN should be directed to CommercialPolicy@gov.wales